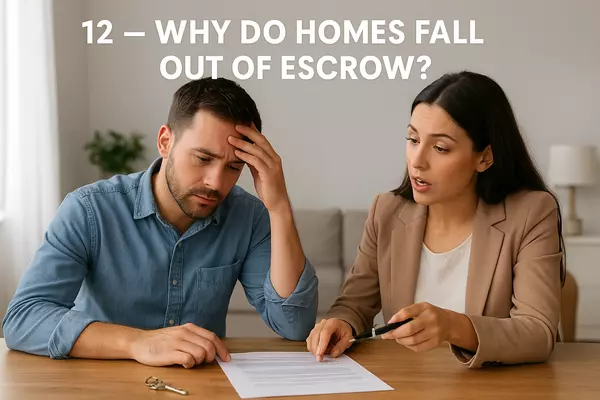

Why Do Homes Fall Out of Escrow?

1. Financing Problems

One of the biggest reasons escrows crash is financing. A buyer may have weak pre-qualification, unstable income, or unexpected credit issues. This is why I only recommend lenders who thoroughly pre-approve buyers upfront. Solid underwriting prevents last-minute surprises.

2. Low Appraisal

If the appraisal comes in below the purchase price, buyers may panic. But there are solutions — appraisal rebuttals, value reconsiderations, seller credits, or creative negotiations. I’ve saved countless deals by jumping ahead of problems with strong comps and strategic conversations with the appraiser and lender.

3. Inspection Findings

Repairs can trigger cancellations when emotions run high. My approach: anticipate issues early. Before listing, I evaluate your home for potential inspection red flags. For buyers, I negotiate credits or repairs that protect your investment without jeopardizing the deal.

4. Buyer Cold Feet

Real estate is emotional. Sometimes buyers get overwhelmed. Strong communication, expectation-setting, and a calm strategy keep clients grounded.

5. Contract Misunderstandings

Miscommunications about timelines, inclusions, or contingencies can derail a deal. I resolve this with clear expectations, daily communication, and proactive management of every milestone.

Escrows don’t fall apart randomly — they fall apart when no one is actively managing details. My job is to anticipate every move, protect your position, and keep deals on track from open to close.

Categories

Recent Posts