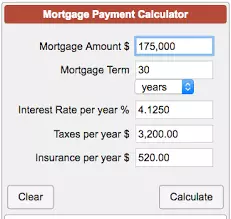

How Do Interest Rates Affect My Buying Power?

Interest rates are one of the biggest factors in home affordability. A small rate change can significantly adjust what you qualify for — and what you feel comfortable paying.

For example, on a $500,000 loan:

-

At 6%, your payment (P&I) is about $2,998/mo

-

At 7%, it’s about $3,326/mo

Just 1% can cost you roughly $328 more per month, which can lower your approved purchase price by tens of thousands of dollars.

That’s why timing, loan structure, and negotiation matter. I help clients:

-

Use seller credits to lower rates

-

Explore buydowns

-

Compare FHA vs. Conventional

-

Understand future refinancing opportunities

When we shop for homes, we don’t just look at price — we look at payment. And that is where smart planning wins.

Categories

Recent Posts

10 Most Asked Real Estate Questions Heading Into 2026

What Are Contingencies in a Real Estate Contract?

What Is An Earnest Money Deposit?

What If the Appraisal Comes In Low?

How Do Interest Rates Affect My Buying Power?

How Can I Increase My Home’s Value Before Selling?

Should I Buy New Construction or Resale?

How Do Real Estate Comissions Work?

What Is Included in a Mortgage Payment?

Why Do Homes Fall Out of Escrow?