What’s the Difference Between Pre-Qualified and Pre-Approved?

Understanding the difference between being pre-qualified and pre-approved can make or break your homebuying experience. In today’s competitive Southern California and High Desert markets, the type of approval letter you hold directly impacts your negotiating power, your offer strength, and your chances of actually closing on a home.

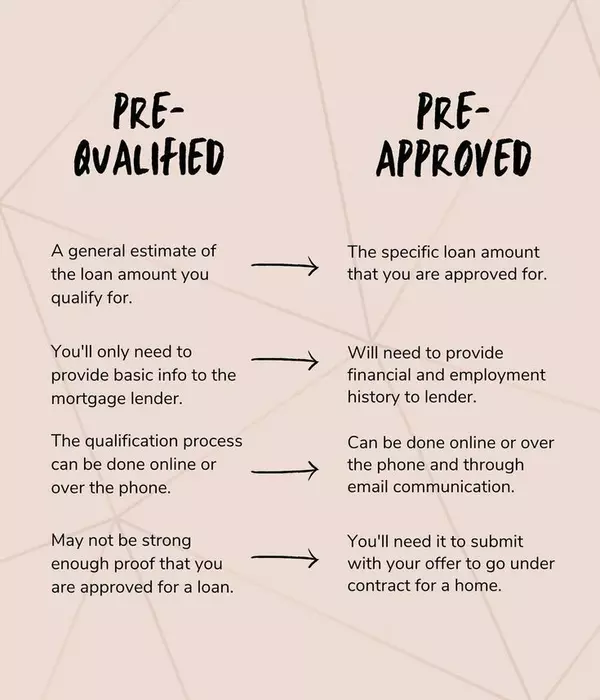

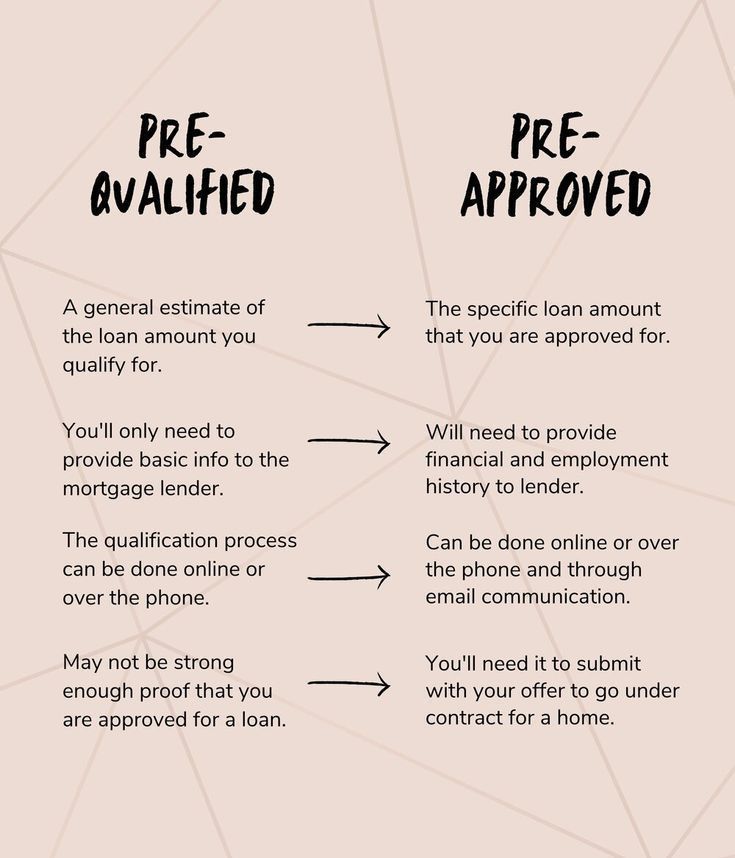

Pre-qualification is the very first step. It’s quick, often online, and based on the information you tell the lender — estimated income, credit score, debts, and assets. While this is helpful for getting a general idea of your buying range, it carries zero verified data. Sellers and listing agents know this, which is why pre-qualification letters rarely hold weight when offers are reviewed.

Pre-approval, on the other hand, is the gold standard. This requires a lender to fully review your actual financial documentation — tax returns, pay stubs, bank statements, W-2s, credit report, and employment history. With this deeper review, a lender confirms you are highly likely to be approved for a loan up to a specific amount.

Categories

Recent Posts