How Much Do I Need For a Down Payment?

The myth that you need 20% down to buy a home stops a lot of great buyers before they even start. The reality in Southern California—especially here in the High Desert—is that down payment options are flexible, and the right structure depends on your financial profile, timeline, and the type of home you’re purchasing.

Conventional loans often allow as little as 3–5% down for qualified buyers. This can be ideal for borrowers with solid credit who want to preserve cash for renovations, reserves, or investments. FHA loans typically start at 3.5% down and can be more forgiving on credit history. VA loans (for eligible active-duty service members, veterans, and some surviving spouses) frequently offer zero down with competitive terms. There are also down payment assistance programs that can bridge the gap for first-time and repeat buyers—some based on income, geography, or profession.

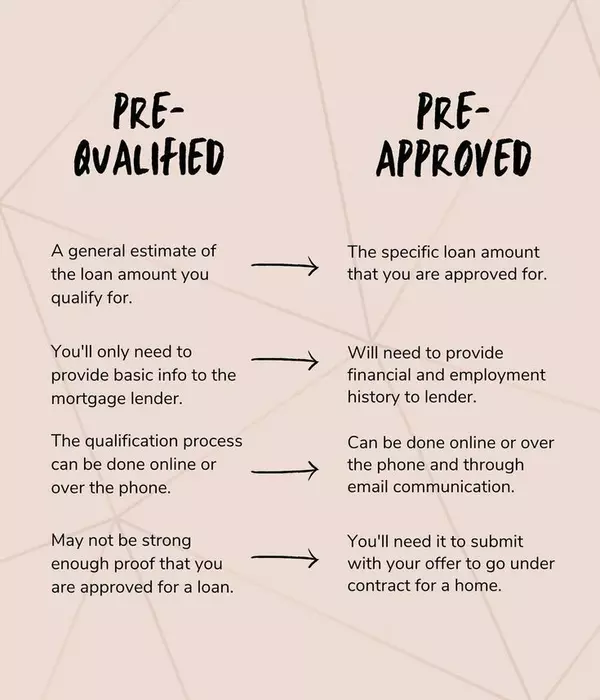

Your down payment level influences three things: your monthly payment, your interest rate/pricing, and whether you’ll have mortgage insurance (MI). With less than 20% down on a conventional loan, private MI is common, but it can drop off once you reach the required equity. With FHA, MI lasts longer, but the trade-off may be easier qualification and a lower initial down payment.

Locally, we also consider property type (single-family vs. condo vs. land/new build), appraisal values, and seller expectations. In competitive areas—think Apple Valley pool homes, Spring Valley Lake waterfronts, or turnkey Hesperia properties—stronger down payments can help your offer stand out. That doesn’t always mean more cash; sometimes it’s about strategic terms, faster timelines, or appraisal gap planning.

My process begins with a quick, confidential strategy call, followed by a lender introduction suited to your goals. We’ll clarify your ideal monthly payment, cash-to-close comfort, and options to reduce MI or interest rates through seller credits or rate buydowns. From there, I align your home search with realistic—yet aggressive—financing paths so you can win the right home without overextending.

Curious what’s possible with your budget? I’ll map out down payment paths and pair you with a lender who can deliver. You might be closer to owning than you think.

Categories

Recent Posts